For businesses selling and shipping to the EU, and unsure about dealing with new EU customs tax procedures, we have found a website to help simplify the process. Alavara.com helps businesses with many different types of tax, including customs duty and import tax. They can help you with registering and reporting VAT, and ensures you stay compliant with EU regulations. Take a look at their website to see if they can help take some of the stress out of the new and complicated EU tax laws.

0 Comments

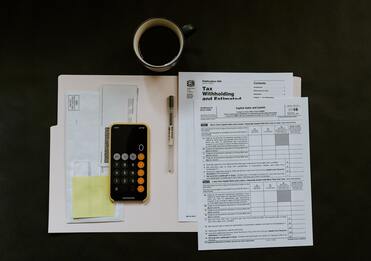

From July 1st 2021, business to customer sellers need to be aware of VAT reforms put in place by the European Union. Below is a quick summary of the most important changes to be aware of:

To read about these changes in more detail, you can visit the official European Union VAT guidance page or see this IOSS factsheet from the General for Taxation and Customs Union.

Given the current circumstances regarding Covid-19, we have updated our health and safety practices to help keep everyone safe.

We aim to:

If you're wondering what we're to reduce our environmental impact, you can read our new environmental policy below:

ENVIRONMENTAL POLICY 2021 Alpaca Parcel Ltd is an independent logistics company for work-related to Warehousing, Pick and Pack activities and logistics. Alpaca Parcel Ltd is committed to the continuous improvement of environmental performance and management and the prevention of pollution from the activities we undertake. We will comply with all applicable legal and other relevant requirements that relate to our environmental aspects, official codes of practice and, as far as practicable, accepted best practice in environmental management. We are committed to: 1)Implementing energy saving technologies and initiatives 2)Adopting strategies to minimise the environmental impacts of business travel. 3)Using utilities in a responsible and economic way to minimise negative impacts on the environment. |

Alpaca Parcel LtdArchives

July 2021

Categories |

RSS Feed

RSS Feed